Establishing a robust and enduring relationship entails more than just shared interests and emotional bonds. Beyond the initial excitement and affection experienced by a couple, one often neglected factor that holds significant sway in relationship harmony is financial compatibility. While love and understanding are fundamental, matters concerning money can profoundly influence the dynamics of a romantic partnership. This month, as we celebrate love, let’s delve into why financial compatibility is pivotal for fostering a healthy and harmonious relationship:

Communication and trust

Financial compatibility promotes open communication and trust between partners. When couples align on their financial goals, spending habits, and budgeting strategies, it establishes a foundation of transparency. Regular conversations about money help prevent misunderstandings and cultivate trust, fostering a sense of security within the relationship.

Shared goals and values

Money often reflects personal values and life aspirations. Couples with similar financial aims are more likely to share broader life objectives. Consensus on financial norms is also crucial. For instance, in the Philippines, traditional expectations may dictate that the groom bears the wedding expenses, but modern couples often opt for equitable arrangements. Whether planning for a wedding, saving for a home, or investing in their children’s education, aligned financial goals ensure both partners work towards a shared future.

Reduced conflict and stress

Financial disagreements can lead to significant relationship strain. Irresponsible spending and obligations to support extended family members, common among Filipinos, can exacerbate tensions if not addressed jointly. Financial compatibility minimizes conflicts related to spending, debt management, and long-term planning. Understanding each other’s financial attitudes enables proactive resolution of potential issues, fostering harmony in the partnership.

Adaptability in Times of Crisis

Life’s uncertainties can bring unforeseen financial challenges. Financially compatible couples are better equipped to navigate crises together, whether it’s job loss, medical emergencies, or economic downturns. A solid financial footing enables partners to face adversity without letting financial stress strain their relationship.

Individual Well-being

Personal financial stability directly impacts individual happiness and overall quality of life. Whether in single- or dual-income households, prioritizing financial health enhances each partner’s well-being and relationship satisfaction. Shared commitment to financial stability contributes to mutual fulfillment and contentment.

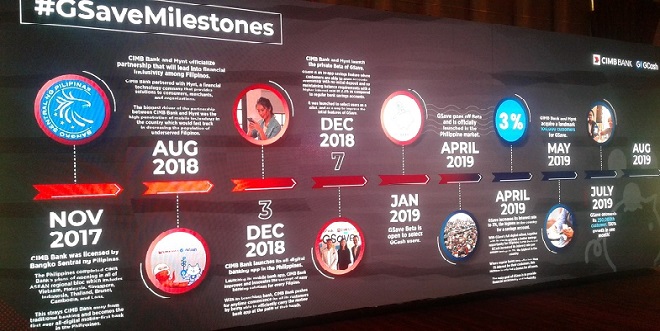

The significance of financial compatibility in relationships cannot be overstated. Being on the same financial page can significantly impact building a shared future. Leveraging financial tools like CIMB Bank PH’s MaxSave Time Deposit can further support couples in achieving their goals. With competitive interest rates of up to 7.5% per annum and flexible tenure options, this next-generation time deposit product can maximize savings potential.

CIMB Bank PH also offers Personal Loans ranging from PHP 30,000 to PHP 1 million, catering to various life needs such as wedding funds, education expenses, or home renovations. The application process takes just 10 minutes, requiring only one valid ID and payslip.

With mutual financial understanding and appropriate financial tools, couples are better equipped to navigate life’s challenges and build a resilient foundation for a fulfilling relationship.