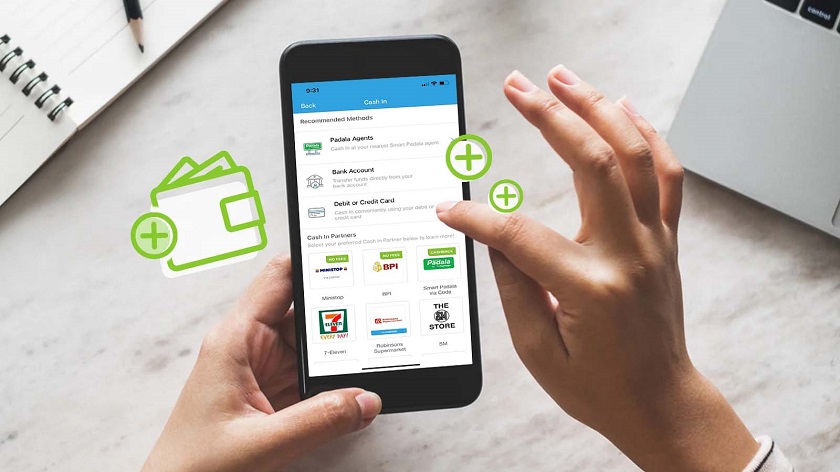

Running low on funds on your PayMaya account? Worry not, because adding funds to your go-to e-wallet is now easier than ever as PayMaya expands to over 90,000 cash in touchpoints nationwide – the most extensive network offered by an e-wallet in the Philippines.

To make your cashless experience hassle-free and even more accessible, you can cash in for free at 55,000 of these touchpoints – including your BPI online banking (via linked account), your go-to Ministop branch, and your trusted Smart Padala agent.

Adding to PayMaya’s nationwidest network of cash in touchpoints are top supermarkets and leading establishments, including 7-Eleven, Robinsons Supermarket, Robinsons Department Store, SM Hypermarket, SM Supermarket, SM Department Store, Landers, Super8, Southstar Drug, Bayad Center, Easymart, EC Pay, LBC Express, No Brand, Palawan Pawnshop, Posible, RD Pawnshop, Savemore, Shopwise, The Marketplace, among others. These establishments also allow PayMaya users to cash in to their accounts for free for a monthly aggregate amount of up to P10,000.

Meanwhile, you can also choose to cash in to your account from the comforts of your home using online channels like mobile banking via Instapay, or by linking any Visa, Mastercard, or JCB card to your account.

“We are breaking the barriers to digital payments adoption and usage by offering the most extensive cash in channels. With this unparalleled network plus our free cash in offer, we are making it easier for Filipinos to embrace digital payments,” said Shailesh Baidwan, President at PayMaya Philippines.

Once users fund their PayMaya accounts, they can now utilize safe and convenient digital payments for their everyday transactions. They can use their PayMaya to purchase their daily essentials at any of the over 360 brands featured on the PayMaya Mall, on their favorite shopping sites, or their go-to establishments. They can also access and pay 600 billers on the PayMaya app or send money even to those without a bank account through Smart Padala.

PayMaya is an end-to-end digital payments ecosystem enabler in the Philippines with platforms and services that cut across consumers, enterprises, communities, and government. Through its enterprise business, it is one of the leading payments processors for “everyday” merchants in key industries such as retail, food, transportation, utilities, and eCommerce. It provides more than 38 million registered users access to financial services through its consumer platforms. Customers can conveniently cash in, pay, cash out, and remit through its over 300,000 digital touchpoints nationwide.

Its Smart Padala by PayMaya network of 55,000 partner agent touchpoints nationwide serves as last-mile financial hubs in communities, providing the unbanked and underserved access to digital services.