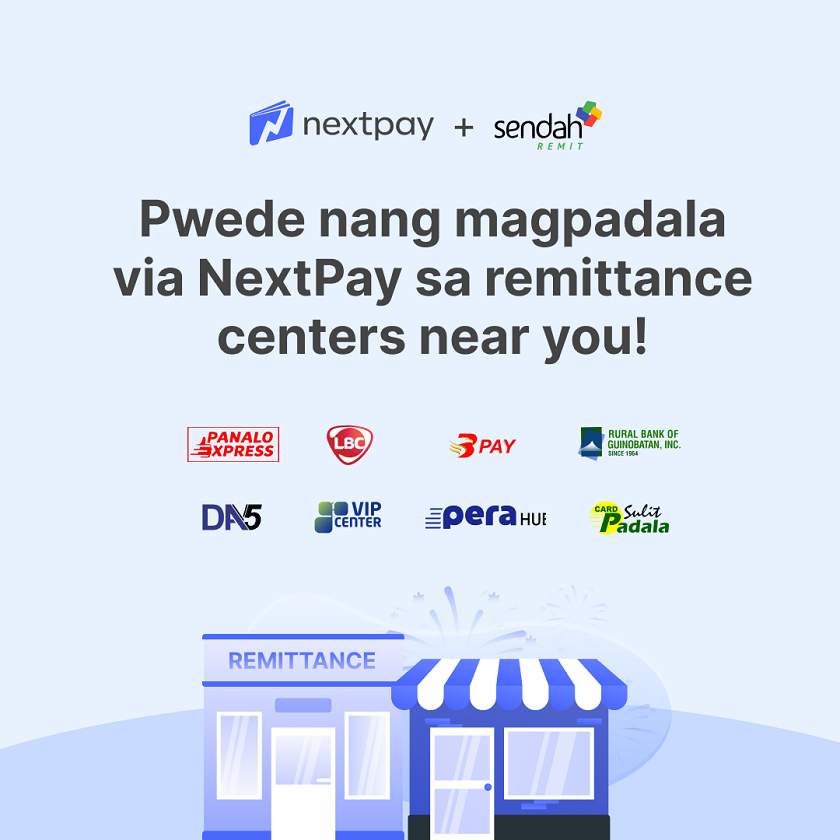

Homegrown fintech startup NextPay, a digital financial solutions platform, has partnered with local online-to-offline (O2O) payments provider Ayannah to allow its customers to disburse funds to unbanked recipients.

The partnership enables small businesses to send money to their employees, suppliers, and customers through almost 10,000 partner remittance centers nationwide. NextPay users may send money to a single individual or do batch disbursements to several recipients.

“We understand that a majority of our population are still unbanked with only three out of 10 Filipinos owning a bank account. Even with the pervasiveness of eWallets, a huge part of the population still does not have access to basic financial services. NextPay aims to serve them by allowing unbanked recipients to receive funds through the nearest remittance centers in their area,” NextPay Chief Executive Officer and Co-Founder Don Pansacola said.

Senders may use the NextPay platform to disburse funds to their recipients. They simply have to click on the “disbursements” tile on the NextPay dashboard and input the personal details of the recipient. Then, they can choose “remittance center” as their receiving option and confirm the transaction.

Recipients will then receive a text message and an email containing the transaction reference number. They may claim the funds through the almost 10,000 branches of remittance centers nationwide. Remittance center partners include LBC, Tambunting, Raquel Pawnshop, Panalo Express, RD Pawnshop, ACM-VIP, and Sendah Direct Agents.

Disbursement through remittance centers cost as low as P5 per transaction.

“This online-to-offline service enables us to strengthen our shared goal of providing basic financial services to more Filipinos — especially the unbanked. By partnering with NextPay, we are also simplifying the process of disbursements for growing businesses and even individuals,” Ayannah Founder Mikko Perez said.

More digital solutions introduced since seed funding

Aside from offline remittance, NextPay has also introduced various digital financial solutions since it secured fresh funding in the first half of 2021, including the introduction of payment links and the BETA testing of corporate cards.

Payment links are easily generated and can be single-use or reusable. They allow businesses to collect customer payments easily by letting them click on a link that allows them to settle with the payment method they prefer.

This new feature is useful for online sellers, as they only have to attach the payment link on their product description.

Corporate Cards, meanwhile, allow business owners to monitor their transactions easily by having a virtual debit card where bills, subscriptions, and company payments may be charged. This removes the need to use their personal cards for business expenses.

“Since we have successfully raised fresh funding from our investors in the first half of 2021, we have been working to accelerate our growth and introduce more digital banking solutions to support the needs of growing business, freelancers, entrepreneurs, and even startups,” NextPay Chief Experience Officer and Co-Founder Aldrich Tan said.

NextPay successfully raised $1.9 million in an oversubscribed seed funding round led by Singapore-based venture capitalist Golden Gate Ventures and Gentree Fund, a private investment vehicle of the Sy Family, which owns Filipino conglomerate SM Group.

Launched amid the pandemic in 2020, NextPay empowers growing companies, entrepreneurs, and freelancers with a spectrum of digital financial services that were previously unavailable to them because of the steep requirements and high fees that are typically aimed at larger, more developed companies that can afford them.

“We aim to be at the forefront of innovation for digital banking solutions in the Philippines in order to enable more small businesses to make big banking transactions with ease and convenience at very minimal costs. These new solutions are aimed at providing businesses with flexible options to transact and help them focus more on growing their businesses,” Pansacola said.

To learn more about NextPay, please visit https://nextpay.ph.