In the Philippines, a single financial setback can push people into poverty. This underscores the importance of accessible and affordable means to protect one’s finances and livelihood. AXA Philippines recognizes the challenges of living in uncertainty, which is why the company has made it a mission to promote financial security for everyone by offering inclusive insurance products.

Protecting the most vulnerable

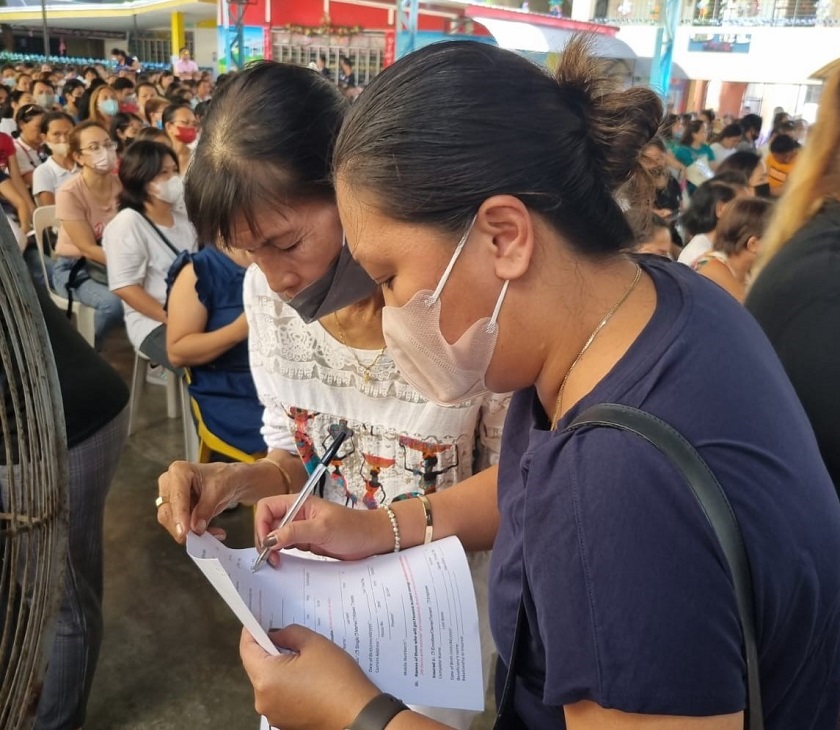

The majority of the local emerging insurance market is composed of low to middle-income workers, such as retail workers, tricycle drivers, sari-sari store owners, teachers, BPO employees, and OFWs. These groups are most vulnerable to financial challenges and would benefit greatly from affordable financial protection.

To address this need, AXA Philippines has made it their mission to protect what matters to Filipinos and expand their protection to more people who remain unprotected from everyday risks. AXA Philippines President and CEO, Bernardo Serrano Lopez, says, “We have inclusive insurance products that cater to nuanced needs and budgets. We’ve also partnered with others to make these easily accessible to those who need protection the most.”

Preparing for life’s most common uncertainties

AXA Philippines is committed to ensuring that everyone has access to financial protection through their inclusive and affordable insurance products. In addition, the company partners with organizations that share the same goal of safeguarding the vulnerable.

One of AXA Philippines’ offerings is the Micro-Protection line, which is designed to cater to the nuanced needs and budgets of low- to middle-income Filipinos. Another product is the comprehensive group insurance bundle that includes life insurance, personal accident coverage, and daily hospitalization income.

For micro-business owners, AXA Philippines provides a micro-property insurance product that covers damage caused by natural calamities. This product includes personal accident insurance, robbery cover, and access to the Emma by AXA PH platform, which provides a range of convenient services.

Working with like-minded partners

As part of its ongoing efforts to promote financial inclusivity, AXA Philippines has forged partnerships with various groups that share the same mission. One such partner is Bixie, an online financial literacy platform that supports women entrepreneurs, and Packworks, an app that helps micro-entrepreneurs improve their processes.

AXA has also made insurance more accessible by teaming up with GCash for its SMS Insure product, which can be easily purchased in-app, and with Cebuana Lhuillier for MicroBiz Protek Jr., a microinsurance product that protects the property of MSMEs. The company has also partnered with Growsari, a tech-enabled ordering platform for micro-entrepreneurs, to offer life insurance to sari-sari store owners through their Loyalty Program.

Moving forward, AXA Philippines is committed to continuing its efforts to make financial protection and security inclusive for all and to bring insurance closer to even more people. For more information about AXA Philippines and its products, visit axa.com.ph.