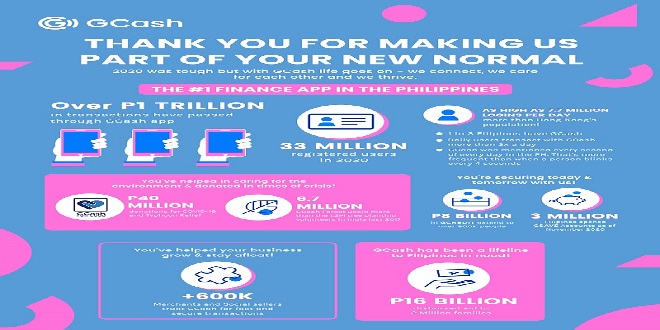

GCash, the undisputed leader and preferred mobile wallet in the Philippines, exceeded its 2020 business targets, one of which is hitting its PHP 1 trillion transaction commitment earlier this year — an impressive 254% YoY growth — while it continues to empower millions of Filipinos with digital financial tools and services that helped them adapt into the new normal.

The service peaked at PHP 7.5 billion daily gross transaction value, and more than 6 million transactions a day. Meanwhile, its customer base ballooned to more than 33 million — a third of the Philippines’ national population — coming from 20 million in 2019.

“The remarkable growth GCash experienced this year shows that Filipinos have embraced financial technology. People have realized that fintech isn’t just an option but a necessity, allowing them to fulfill their financial lifestyle conveniently,” said Martha Sazon, President and CEO of GCash.

The growth is driven by an unprecedented surge in usage in GCash to GCash money transfers, bank transfers, online and offline cash-in services, and bill payments, all of which have become necessities during the pandemic.

According to data from App Annie, a third-party global app ranking firm, GCash has been definitively the number one mobile wallet in the country for eleven consecutive months this year: It widened the gap further inactive users, leading more than double than the next banking app, and almost three times the size of the next mobile wallet.

This reflects the Filipinos’ growing reliance on digital finance to manage their personal finances and to carry on with their daily lives while also staying safe with contactless transactions provided by fintech apps like GCash.

Thanks to GCash’s pivot to fulfill the needs of its customers during the new normal, our growth reached remarkable heights in a span of a few months,” added Sazon.

Part of the strategies driving the mobile wallet’s PHP 1 trillion transaction value growth further is its participation in popular culture and traditions, such as the global 12.12 online sales, and even replacing physical red envelopes — ang paos — with its very own digital version, prompting Filipinos to send money to their loved ones during the holiday season using the GCash app.

GCash is also leading the financial service sector, by inducing more than 3 million Filipinos to open their own savings accounts through GSave as of November 2020 and have extended over PHP 8 billion in much-needed credit through credit. We are positive that fintech services such as GCash will play a key role in the ongoing payment revolution in the Philippines in the coming years,” Sazon said.

GCash’s performance in 2020 accelerates the fulfillment of the Bangko Sentral ng Pilipinas’ Digital Transformation Roadmap, where the agency aims to shift at least 50 percent of retail payment transactions to digital and to have at least 70 percent of Filipinos have their own e-wallet by 2023.

Earlier this year, GCash hit a record PHP 100 billion transaction value during the first seven months of 2020 and has disbursed over PHP 16 billion SAP disbursements to 2 million Filipinos nationwide.

Globe Fintech Innovations Inc. (Mynt), which operates GCash, is part of the portfolio companies of 917Ventures, the largest corporate incubator in the Philippines wholly-owned by Globe Telecom Inc.