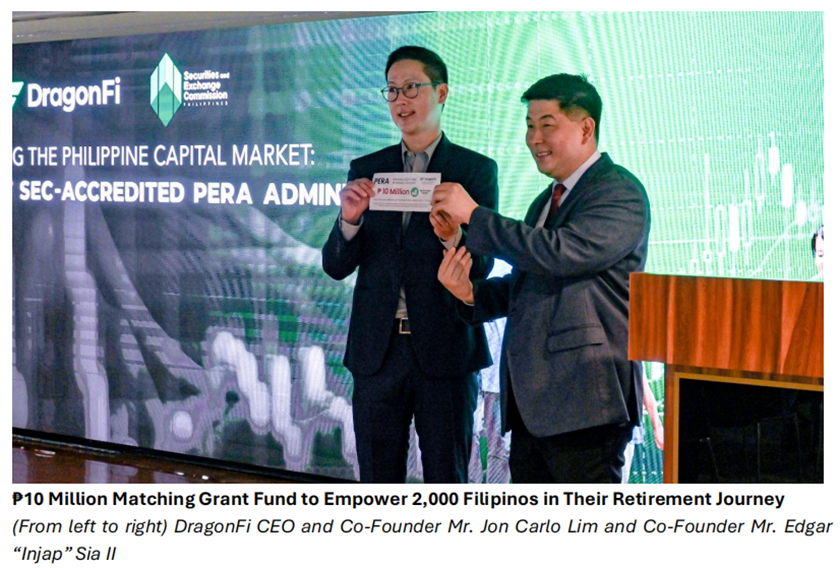

₱10 Million Matching Grant Fund to Empower 2,000 Filipinos in Their Retirement Journey

In a groundbreaking step toward strengthening the Philippine capital market and expanding access to retirement savings, the Securities and Exchange Commission (SEC) has officially certified DragonFi Securities Inc. as the first SEC-accredited Personal Equity and Retirement Account (PERA) administrator.

The event, “Deepening the Philippine Capital Market: Launch of the 1st SEC-Accredited PERA Administrator,” marks a significant milestone in promoting long-term investing and enhancing financial security for Filipinos.

The launch event brought together key industry leaders, including SEC Commissioner McJill Bryant Fernandez, DragonFi CEO Jon Carlo Lim, and DragonFi Co-Founder Edgar “Injap” Sia II, who all underscored the significance of this milestone in shaping the future of retirement savings in the Philippines.

“This is a key undertaking that reflects our shared commitment to advancing the Philippine capital market and ensuring the financial well-being of every Filipino,” said Commissioner Fernandez. He highlighted the SEC’s continuous efforts to enhance the PERA framework, particularly through SEC Memorandum Circular No. 14, Series of 2024, which expanded accreditation guidelines to include securities brokers, investment houses, and fund managers as PERA administrators.

“DragonFi’s accreditation signals a new chapter in making retirement savings more accessible and efficient for Filipinos,” Fernandez added, reaffirming the SEC’s commitment to empowering more individuals to build their retirement wealth.

A Matching Grant to Boost PERA Participation

To encourage more Filipinos to invest in PERA, Edgar “Injap” Sia II has pledged a ₱10 million Matching Grant Fund to support 2,000 young Filipinos, aged 18-35, in jumpstarting their retirement savings. Under this initiative, participants who contribute their first ₱5,000 to a PERA account will receive an additional ₱5,000 in matching funds—effectively doubling their investment.

This initiative is expected to have an immediate and significant impact. With the creation of 2,000 new retirement accounts, the total number of PERA accounts in the country is projected to increase by 35%. Additionally, the ₱20 million infusion into PERA—₱10 million from contributors and ₱10 million from the grant—will contribute to a 4% increase in total PERA contributions, giving a much-needed boost to the country’s retirement savings pool.

“This ₱10 million Matching Grant Fund is one of my ways, as a passionate Filipino entrepreneur, to contribute toward our collective goal of achieving a first-world Philippines,” said Sia.

“Through the PERA program and this initial grant, we’re not just paving the way for 2,000 Filipinos to become future millionaires—we’re igniting a movement that will empower millions of young Filipinos to achieve financial independence in our lifetime.”

Strengthening the Retirement Savings System

As the first SEC-accredited PERA administrator, DragonFi is committed to making retirement savings more accessible, transparent, and efficient. CEO Jon Carlo Lim emphasized the company’s dedication to working with corporations to implement employer-matching programs, while also advocating for continuous improvements in the PERA framework.

“Our mission is to ensure that every working Filipino has the ability—and the motivation—to invest in their future,” Lim stated. He also stressed the importance of evolving PERA policies to align with global best practices, ensuring that the program serves as a true catalyst for financial security and capital market growth.

“With strong support from regulators, businesses, and individual investors, PERA has the potential to reshape the way Filipinos prepare for retirement,” Lim added.

Filipinos will soon be able to open PERA accounts through DragonFi, with the company set to launch its PERA services in the second half of 2025.