Rizal Commercial Banking Corporation has sealed a partnership with Lenddo EFL for faster and more convenient financial account opening for Filipinos through an end-to-end digital verification and authentication solution.

With a digital KYC, consumers, particularly those who are unbanked, can open deposit accounts, apply for loans online, take out new insurance policies, do money transfers, and pay over 2,000 billers through RCBCs Diskar Tech virtual bank in less than five minutes, anytime, anywhere.

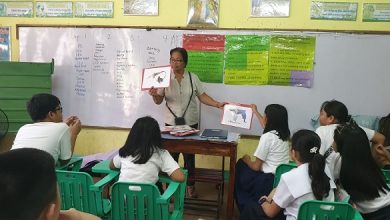

Rizal Commercial Banking Corporation President and CEO Eugene Acevedo and LenddoEFL Managing Director Mark MacKenzie (center) have signed an agreement to integrate Know Your Customer processes for RCBC’s DiskarTech virtual bank. They are joined by (from left) RCBC Retail Banking Group’s Lhan Bendal, Retail Banking Group Head Richard Lim, Chief Innovations and Inclusion Officer Lito Villanueva, LenddoEFL Sales Director Judity Dumapay, and RCBC Retail Banking Group’s Em Valdes.

Government regulator Banko Sentral ng Pilipinas (BSP) has been at the forefront in championing inclusive digital finance and digitalization through emerging regulations leveraging technology.

Overcoming the barriers to digital connectivity will not only promote access to digital financial products, but will allow innovators to improve the design, enhance security features, and drive down the cost of financial services, in a speech delivered by BSP Governor Benjamin Diokno at the recent 2019 Financial Executives conference.